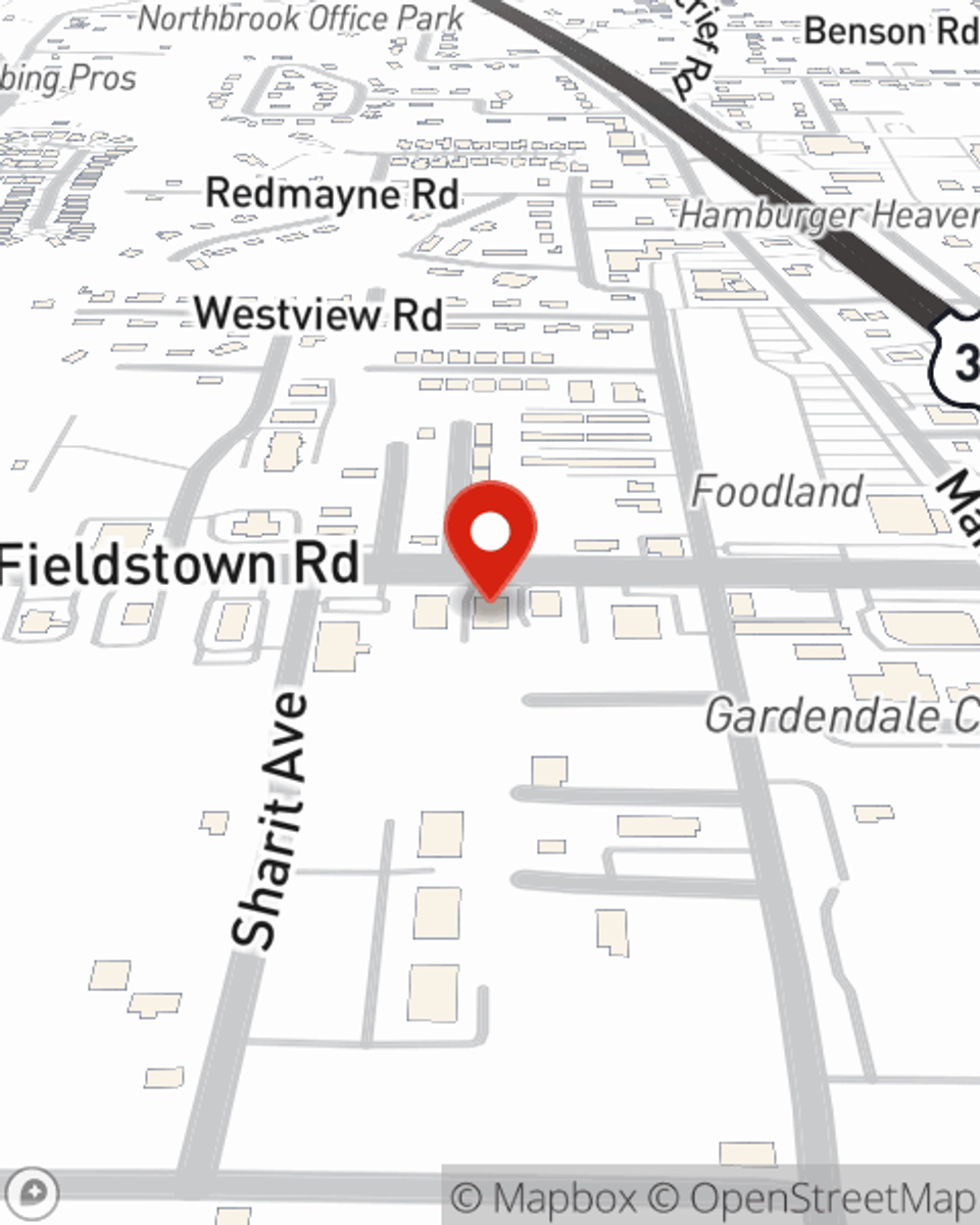

Business Insurance in and around Gardendale

Looking for coverage for your business? Search no further than State Farm agent Scott Cantrell!

Helping insure small businesses since 1935

- Fultondale

- Warrior

- Morris

- Kimberly

- Birmingham

- Hayden

- Pinson

- Mt. Olive

- Adamsville

- Cullman

- Dora

- Sumiton

- Jasper

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to remember. We understand. State Farm agent Scott Cantrell is a business owner, too. Let Scott Cantrell help you make sure that your business is properly protected. You won't regret it!

Looking for coverage for your business? Search no further than State Farm agent Scott Cantrell!

Helping insure small businesses since 1935

Protect Your Future With State Farm

If you're looking for a business policy that can help cover business liability, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

At State Farm agent Scott Cantrell's office, it's our business to help insure yours. Get in touch with our outstanding team to get started today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Scott Cantrell

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.